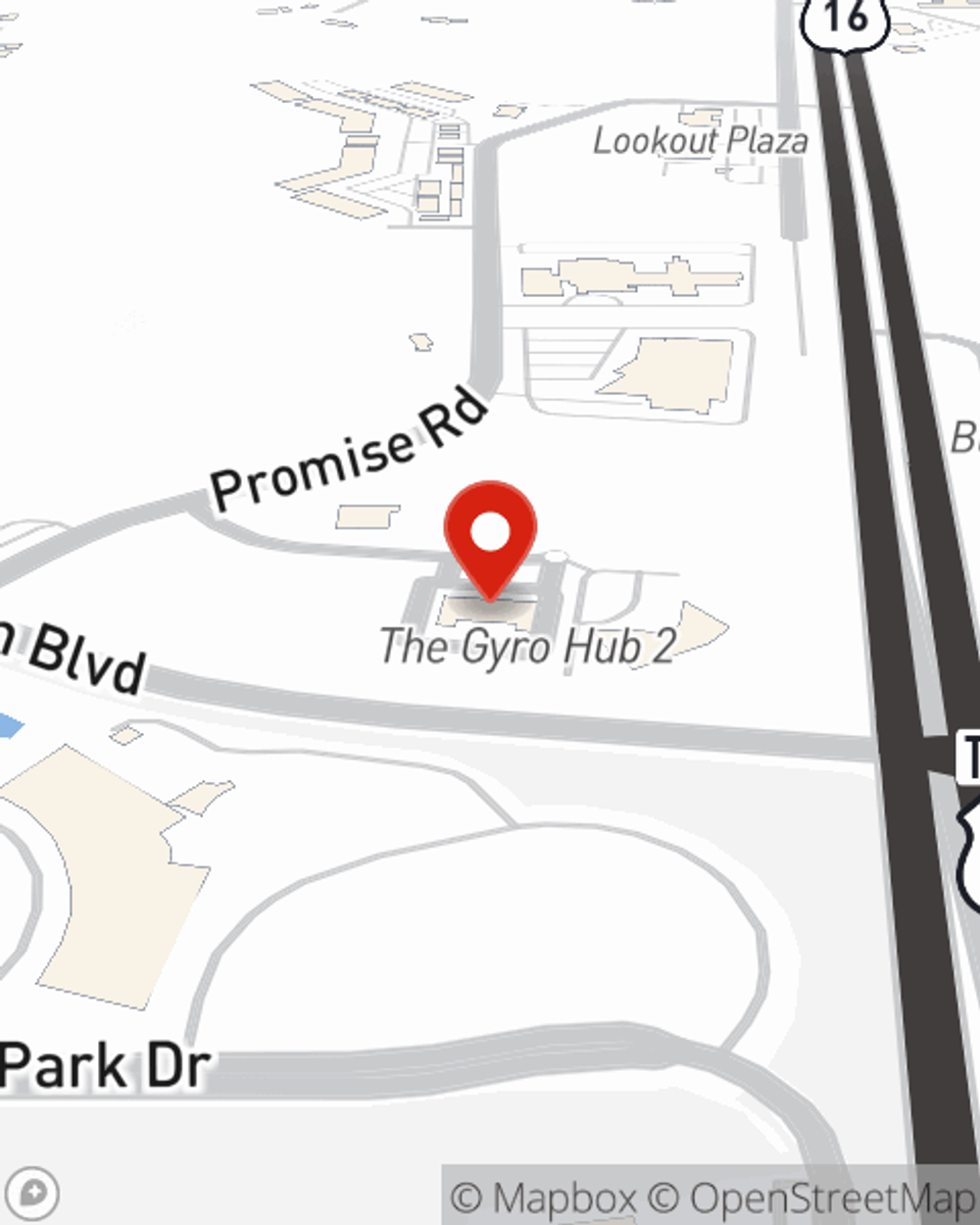

Business Insurance in and around Rapid City

One of the top small business insurance companies in Rapid City, and beyond.

This small business insurance is not risky

- Rapid City

- Box Elder

- New Underwood

- Hot Springs

- Black Hawk

- Piedmont

- Hermosa

- Keystone

- Hill City

- Spearfish

- Sturgis

Help Prepare Your Business For The Unexpected.

Running a business is about more than being your own boss. It’s a lifestyle and a way of life. It's a commitment to a bright future for you and for the ones you care for. Because you give every effort to make your business thrive, you’ll want small business insurance from State Farm. Business insurance protects all your hard work with errors and omissions liability, worker's compensation for your employees and business continuity plans.

One of the top small business insurance companies in Rapid City, and beyond.

This small business insurance is not risky

Get Down To Business With State Farm

Your company is special. It's where you earn a living and also how you make a life—for yourself but also for your loved ones, and those who work for you. It’s more than just a shop or a facility. Your business is a reflection of all your hopes and dreams. Doing what you can to keep it safe just makes sense! A next great step is to get outstanding small business insurance from State Farm. Small business insurance covers numerous occupations like a taxidermist. State Farm agent Gregg Fullerton is ready to help review coverages that fit your business needs. Whether you are a fence contractor, a dog groomer or a piano tuner, or your business is an ice cream shop, a bicycle shop or a window treatment store. Whatever your do, your State Farm agent can help because our agents are business owners too! Gregg Fullerton understands the unique needs you have and is ready to review coverages that meet your needs. With State Farm, you’ll be ready to grow your business into a bright future.

Get right down to business by calling or emailing agent Gregg Fullerton's team to explore your options.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.

Gregg Fullerton

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

The landlord's guide to the eviction process

The landlord's guide to the eviction process

Evictions can be a lengthy, daunting process for landlords and tenants, so it’s important for you to be aware of the specific reasons, procedures and costs.